Bankruptcy

Bankruptcy serves two purposes. First, it gives an honest debtor a “fresh start” in life by relieving the debtor of most debt.

Second, it repays creditors in an orderly manner to the extent that the debtor has property available for payment.

Bankruptcy Overview

Effective October 17, 2005, the new bankruptcy law requires an individual to receive a briefing from an approved non-profit budget and credit counseling agency before filing bankruptcy. By completing a counseling session, a consumer may have more knowledge about bankruptcy. Thus they may be better able to make an informed decision.

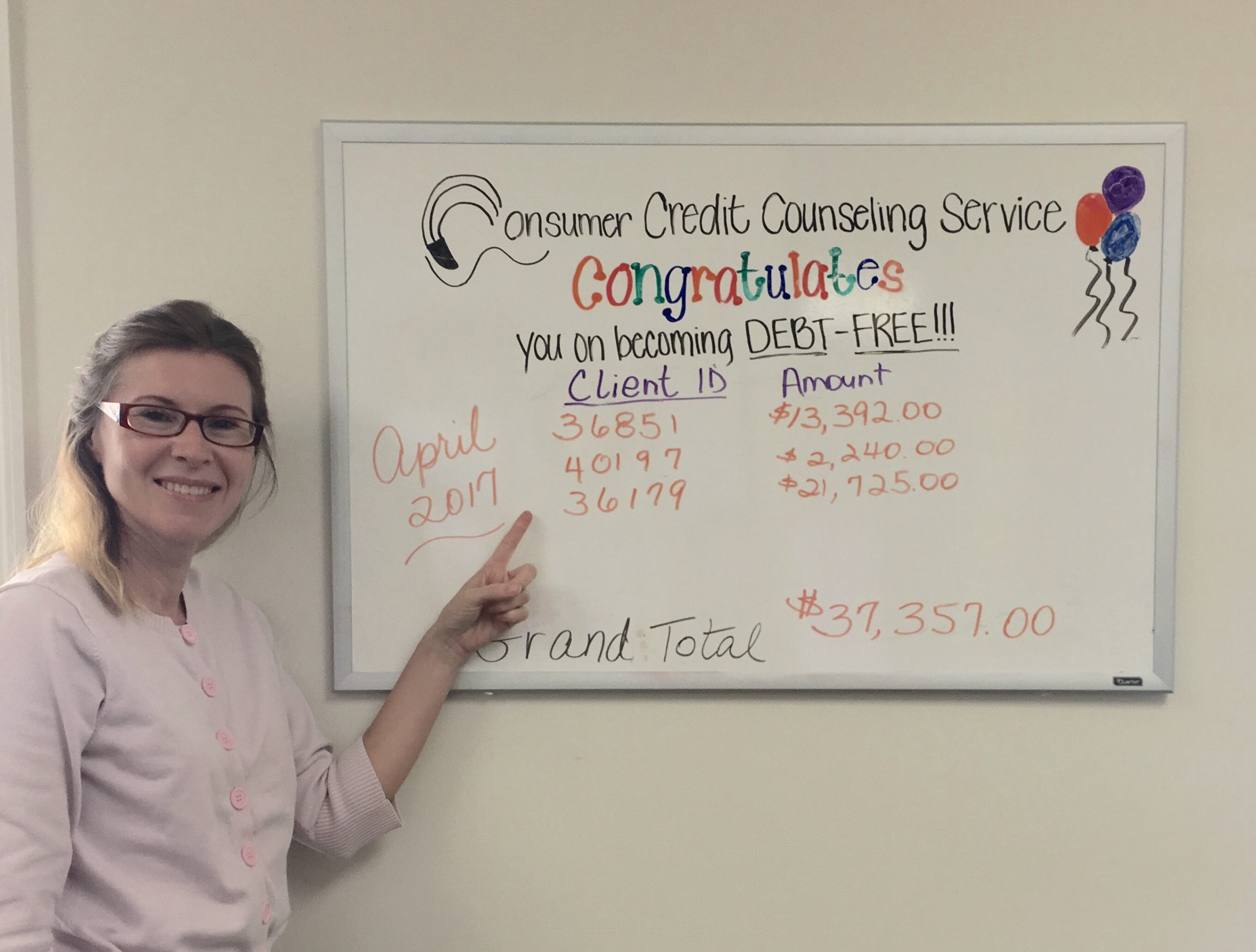

Consumer Credit Counseling Service of the Savannah Area, Inc. has been approved (*) by the Executive Office for U.S. Trustees (EOUST) to offer pre-filing bankruptcy counseling in all judicial districts in Georgia and South Carolina.

Bankruptcy serves two main purposes: First, bankruptcy intends to give an honest debtor a “fresh start” in life by relieving the debtor of most debts. Secondly, bankruptcy repays creditors in an orderly manner to the extent that the debtor has property available for payment.

Nondischargeable debt

A nondischargeable debt is a debt that you cannot eliminate in bankruptcy. There are various nondischargeable debts. Examples include debts for alimony or child support, certain taxes, debts for most government-funded or guaranteed educational loans or educational benefit overpayments, and debts arising from death or personal injury caused by driving while intoxicated or under the influence of drugs.

The two primary forms of Personal Bankruptcy are Chapter 7 and Chapter 13.

Chapter 7, often called a liquidation, allows debtors a fresh start by requiring them to relinquish non-exempt assets. These assets become liquidated to pay creditors. In return, debtors receive a discharge of their debt with the exception of certain types of non-dischargeable debt. This form of bankruptcy provides for relatively quick elimination of most debts and does not require payments to creditors after the bankruptcy filing, as chapter 13 does. However, consumers with income over certain amounts may not be eligible to file a chapter 7. Credit reporting agencies may report a chapter 7 bankruptcy for up to 10 years.

Chapter 13 bankruptcy is for an individual debtor who has a regular source of income. This type of bankruptcy often enables the debtor to keep a valuable asset, such as a house. The debtor proposes a “plan” to repay creditors over time, usually three to five years. Unlike in Chapter 7, debtors are not eligible to have their debts discharged at the beginning of the case. Credit reporting agencies may report a chapter 13 bankruptcy for up to 10 years.

*Approved to issue certificates in compliance with the Bankruptcy Code. Approval does not endorse or assure the quality of an Agency’s services.

The information contained on this website regarding bankruptcy is an overview and is not comprehensive. Further, it is for informational purposes only and is not to be considered legal advice. You should consult with an attorney for advice about your specific legal situation.

Counseling

The goal of the session is to provide a review of the individual’s financial situation. The CCCS will not give legal advice. However, the CCCS will provide you with a comprehensive overview of your financial situation, including budget analysis and net worth estimate. The counselor will also review and discuss possible alternatives to bankruptcy.

CCCS charges $50.00 (or $75 for a couple) for the pre-filing certificate. If your income is at 150% of the Federal poverty level, you are eligible for a fee waiver. Please call our offices for more details.

Bankruptcy Resources

Effective October 17, 2005, the new bankruptcy law requires an individual to receive a briefing from an approved non-profit budget and credit counseling agency prior to filing bankruptcy. By completing a counseling session, a consumer may have more knowledge about bankruptcy and thus may be better able to make an informed decision.

Another significant change of the new bankruptcy code is the adoption of the “means test.” A consumer’s eligibility to file Chapter 7 depends on his/her means, which is the consumer’s income and expenses relative to local and national standards. The consumer’s attorney will need to complete the means test based on his/her financial situation prior to filing a Chapter 7 bankruptcy.

Consumer Credit Counseling Service of the Savannah Area, Inc. has been approved (*) by the Executive Office for U.S. Trustees (EOUST) to offer pre-filing bankruptcy counseling in all judicial districts in Georgia and South Carolina.

The goal of the agency’s pre-filing bankruptcy counseling is to provide an objective view of an individual’s financial situation. During a pre-filing bankruptcy counseling session, we discuss some information about bankruptcy. The information includes the nuances of bankruptcy, the consequences of bankruptcy, and alternatives to bankruptcy. Also, we will conduct a budget analysis and develop a net worth financial statement. Although the paperwork related to the initial application may be completed on this website, the actual pre-filing bankruptcy counseling session will be conducted either via telephone, face-to-face, or online. Consumers needing pre-filing bankruptcy counseling can complete the required forms on this website and wait for our staff to contact them, or simply contact our agency to schedule a session.

At the conclusion of the counseling session, the CCCS will issue a certificate indicating completion of the pre-filing bankruptcy counseling requirement. This certificate is valid for 180 days from the date and time of the counseling. To help cover the cost of providing this service, CCCS charges a fee of $50 to reimburse the administrative and counseling costs. For a married couple, two (2) certificates will be issued after counseling for a fee of $75 provided they participate in a joint counseling session. In limited circumstances, a client may be eligible to have this fee waived. Unless waived, the client must pay the fee at the time of the counseling session. However, if a client cannot keep his/her first pre-bankruptcy appointment, the agency requires the client to pay the fee before they can schedule another appointment. This is to ensure that valuable appointment times are not wasted.

(*) Approved to issue certificates evidencing completion of a budget and credit counseling course in compliance with the Bankruptcy Code. Approval does not endorse or assure the quality of an Agency’s services.

Eligibility: Effective for cases filed on or after October 17, 2005, federal bankruptcy law requires the application of a “means test” to determine if a debtor qualifies for relief under chapter 7. Individuals who have income equal to or below the state median income level are generally eligible to file a chapter 7. If a debtor’s income is in excess of his/her state median income level, the “means test” is applied. The means test is a complicated formula which analyzes the debtor’s income and expenses.

Chapter 7 is a liquidation requiring that the debtor give up a non-exempt property, which may include furniture, jewelry, and household contents that are sold by a trustee to pay creditors. Debtors make an election, subject to objection by the chapter 7 trustee and creditors, regarding their non-exempt property. Creditors can appear at the creditors’ meeting, which generally takes place 30 days after the filing of the bankruptcy petition. After approximately 90 days from the bankruptcy filing, most debts are discharged, assuming there are no objections filed with the court and the consumer has completed a required personal financial management course.

Chapter 7 Advantages:

Eligibility: To be eligible to be a chapter 13 debtor, individuals must meet, among other things, the following two requirements: (i) they must have a regular income, and (ii) their debts must not exceed a certain amount. If the individual’s current monthly income is less than the applicable state median income, the plan will generally be set up for three years, although the court may approve a longer plan. If the debtor’s current monthly income is greater than the applicable state median, the plan is generally for five years.

Chapter 13 provides for adjustment of debts of an individual with regular monthly income. Subject to ceilings placed on total debt, individuals who earn regular income may reorganize payments, terms, and interest rates, as well as discharge the remaining portion of debts upon completion of a plan. Chapter 13 allows a debtor to keep property (such as a home) and pay debts over three to five years. A chapter 13 trustee will administer the plan, receiving payments from debtors and disbursing payments to creditors. Debtors usually keep their property but must make regular payments going forward. Debtors receive a discharge upon successful completion of their plan and upon finishing a personal financial management course.

Chapter 13 Advantages:

The information contained on this website regarding bankruptcy resources is an overview and is not comprehensive. Further, it is for informational purposes only and is not considered legal advice. You should consult with an attorney for advice about your specific legal situation.