Financial Step for COVID-19 One: Maximize Income

- If you are eligible, apply for unemployment: https://dol.georgia.gov/gdol-covid-19-information

- What employers are hiring? https://employgeorgia.com/

- Set an appointment to get screened for public benefits:

Financial Step for COVID-19 Two: Rank Expenses

After you have maximized your income, prepare a three-month crisis budget that focuses on your needs. A helpful tool from the Consumer Financial Protection Bureau:

- Housing

- Food

- Utilities

- Transportation

- Everything Else

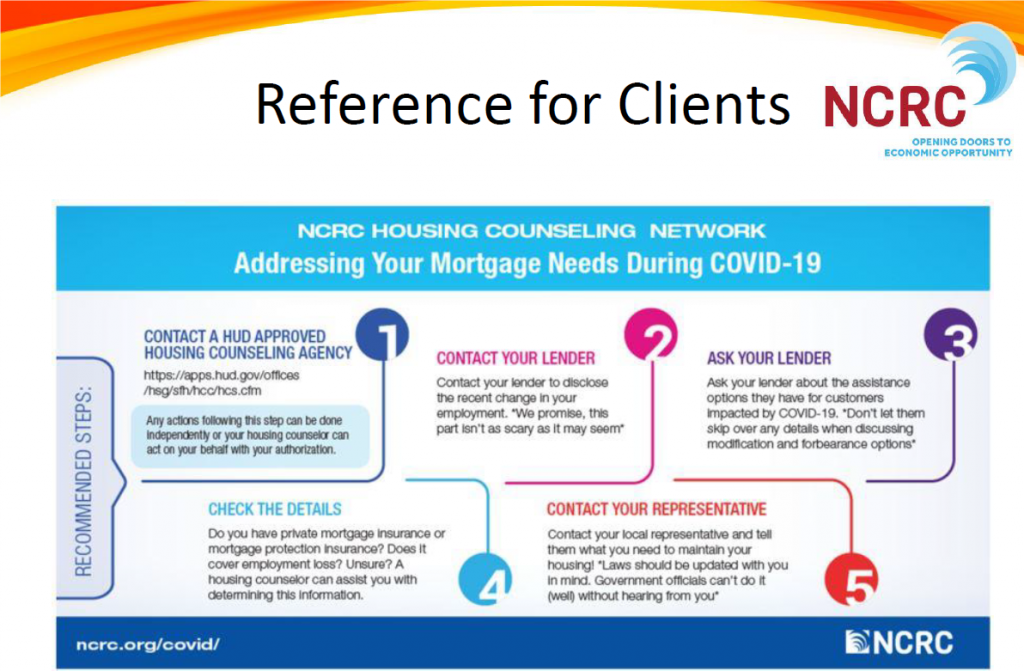

Financial Step for COVID-19 Three: Communicate with Creditors

- Call before you miss or are late with payments

- Use creditors’ websites to avoid long hold times on the phone

- Mortgages, Cars, Student Loans, and Credit Cards

- Get details of offers-Ask about a forbearance (time without payments)? How long? What happens to interest? How do you report it on the credit report? Repayment terms-lumpsum or overtime?

Tips for Student Loans:

https://studentaid.gov/announcements-events/coronavirus

Financial Steps for COVID-19: Call 912-691-2227 or visit https://www.cccssavannah.org/contact-us/ for a phone or virtual counseling session.